The UK’s Dysfunctional Private Equity Ownership and Regulation Model

The UK’s Dysfunctional Private Equity Ownership and Regulation Model Alf Baird Recent problems with Thames Water demonstrate some of the weaknesses with the private equity ownership and regulation model. The inherent weaknesses of this financing approach also impact many other sectors of the UK economy and what are, or were previously regarded as public utilitiesContinue reading "The UK’s Dysfunctional Private Equity Ownership and Regulation Model"

The UK’s Dysfunctional Private Equity Ownership and Regulation Model

Alf Baird

Recent problems with Thames Water demonstrate some of the weaknesses with the private equity ownership and regulation model. The inherent weaknesses of this financing approach also impact many other sectors of the UK economy and what are, or were previously regarded as public utilities and/or public goods.

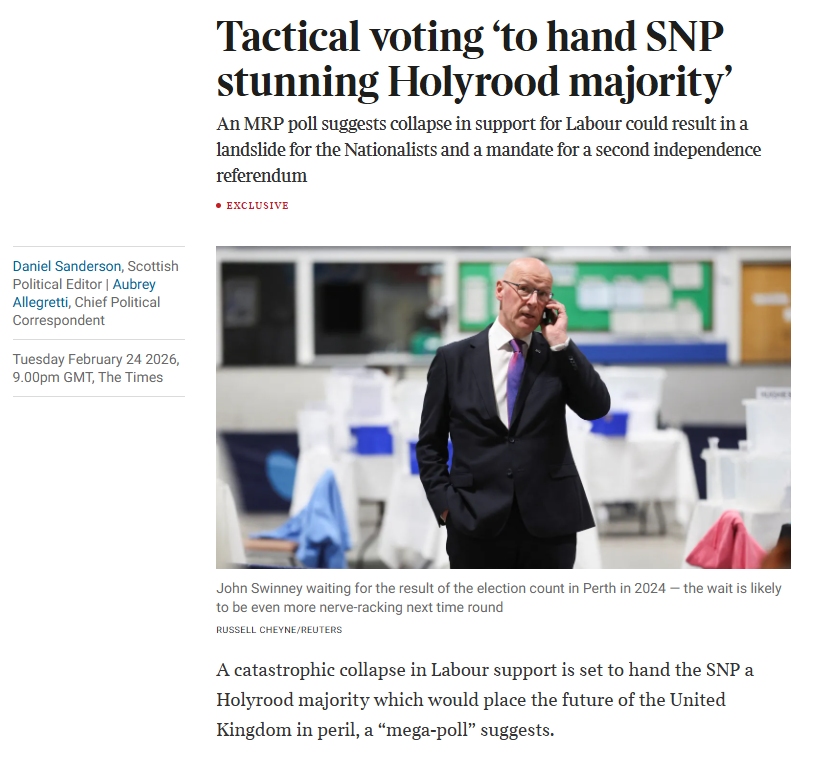

There is currently a petition lodged by concerned local communities at Holyrood to re-nationalise Clydeport. Clydeport was privatized in 1992, and later acquired for £184 million in 2003 by Peel Ports Group. Peel Ports is owned by Isle of Man based property billionaire John Whittaker together with a variety of other international private equity groups. This currently includes Dutch pension fund APG, Australian Super pension fund, private equity funds Olayan of Saudi Arabia, and US headquartered Global Infrastructure Partners.

PRIVATE EQUITY

Private equity fund acquisitions are leveraged transactions in which the finance raised by ‘fund’ managers and used to acquire an asset are treated as debt on the assets balance sheet. Interest is paid on this debt in order for a fund to repay its investors. This means the asset is immediately encumbered with high debt levels demanding high interest payments.

The asset is usually bought for an inflated price which reflects the monopoly position of the asset in its specific market area/region. Clydeport controls all the main ports on the Firth and River Clyde. The company has also been given public ‘port authority’ powers which empower it with significant control and jurisdiction over an extensive geographic area. The regional commercial and regulatory monopoly handed over by the state plus consistent revenue streams allows the asset owner to charge a premium over and above the value of fixed assets when selling the organisation on to another private equity group.

The resulting inflated price paid for a share of the asset by a private equity entity means that high user prices are needed in order to repay the added ‘debt’ resulting from the leveraged acquisition. This means fees and dues levied on ships and cargo tend to be high which makes regional industry less attractive and the economy less competitive.

ALTERNATIVE MODEL

Port infrastructure on the continent (and globally) is mostly publicly owned and publicly planned and developed, with only terminal operations concessioned to specialist private sector operators (Terminal Operating Companies or TOC’s). TOC’s are selected based on their level of expertise and commitment to invest in superstructure such as advanced cranes, yard handling equipment, warehousing and information systems. The public sector is responsible for planning the port estate and providing the basic infrastructure such as quays, navigation channels, and landside access.

PRIVATE EQUITY WEAKNESSES

A further major constraint of private equity ownership concerns the timeframe for return on ‘investment’ in acquiring an asset. Ports, like most other public utilities, are ‘lumpy’ and very long-term investments, whereas private equity is short term. Private equity demands a relatively short timescale to repay fund investors. This usually involves a sale of the asset on to another private equity investor within 7-10 years, in addition to high prices needed to repay the cost (interest) of an inflated-price acquisition.

The financial model is different for state ownership of utility infrastructure. Here the state can decide on a far longer payback period, offering lower user prices, and factoring in wider social and economic benefits from investment in what is regarded as an essential public utility necessary for an economy to trade and a society to function.

Private equity funds also involve significant consultant fees for the ‘financial engineers’ tasked with putting an infrastructure fund together. This may be an ongoing expense for as long as the fund exists. The higher the value of the transaction, the higher the fees will likely be. Fees will certainly amount to millions of pounds annually and this also means there is a need for higher prices and higher returns to be made.

A further major weakness of the private equity ownership model for ports (and most other public utilities) is an inability to take on significant additional debt in order to create new infrastructure to replace obsolete or outdated port capacity. The balance sheet is already heavily loaded with debt from the leveraged acquisition and inflated purchase price of the asset resulting in high interest payments. Prices for port/utility services are already high in order to pay out high amounts of interest to give the fund lenders a satisfactory and immediate return on their loans/debt used to acquire the port.

AN UNSUSTAINABLE BUSINESS MODEL

Most of these features of private equity ownership in ports (and other public utilities/infrastructure) result in what is an unsustainable business model in the long run. Private equity ownership does not allow for the creation of new port infrastructure necessary for trade expansion and economic growth or to replace outdated, obsolete or even dangerous facilities. This means the regional and national economy is heavily constrained. High user prices adversely impact on businesses and consumers and limit the region and nation’s ability to compete internationally.

Private equity ownership of energy, water, and healthcare infrastructure ends up with similar negative outcomes, as we currently see with Thames Water and its lack of investment in new infrastructure over decades since initial privatization. If the UK private equity model assumes a much greater role in healthcare then we will likely see similar outcomes – i.e. high prices and inadequate, crumbling infrastructure unable to cope with demand.

MARKET FAILURE

Market failure occurs because the government has transferred public port authority jurisdiction and responsibilities to a single monopoly private commercial entity who can then use these powers to exclude competing firms from entering the market. This added market power also serves to inflate the sale price/value of the asset, in turn increasing its debt levels and subsequent interest payments to each private equity owner, with a knock-on requirement for higher user charges.

In the alternative public model on the continent (and the ‘norm’ globally) the public port authority is obliged to ensure competition exists within the port estate by concessioning terminals to different TOC’s. The public sector is responsible for investing in and planning port needs for the long-term, plus protecting the public interest and the national economy. This implies new infrastructure can be provided as required.

FOREIGN OWNERSHIP OF STRATEGIC NATIONAL INFRASTRUCTURE

Foreign ownership (as distinct from operations) of ports (and other public utilities) is not permitted by most countries given national dependance on seaports for trade, and for strategic reasons such as defence, safety, and protection of the environment. Clydeport is essentially owned and for the most part self-regulated by non-Scottish and mainly non-UK interests, with excessive/abnormal profits extracted and not used for re-investment. With ‘offshore’ entities, local corporation tax may also be avoided.

TRADE CONSTRAINTS

High user charges necessary to repay high levels of debt on leveraged private equity acquisitions has the effect of constraining trade; conversely, a key function of a public port authority is to facilitate trade, by investing in modern advanced infrastructure and ensuring freight and shipping costs are kept as low as possible.

The lack of any significant investment in new port infrastructure on the Clyde (or Forth and Tay) by successive private owners since privatisation over thirty years ago confirms the failure of this irregular ownership and self-regulation model, which mostly remains unique to the UK. It is what port researchers on the continent termed the ‘Anglo-Saxon Model’ of port privatisation, which is not considered politically acceptable in other countries. The alternative public investment and regulation approach for public utilities is regarded as the ‘Latin model’, in which national strategic land and public utilities remain mostly in ‘dominium populi’, or the public domain/ownership, though may be leased/concessioned to private firms.

ADVERSE EFFECT ON NATIONAL ECONOMY

Scotland’s national economy and society is significantly weakened and disadvantaged from the dysfunctional private equity ownership model applied by successive UK governments to a variety of public utilities/assets. This includes, for example, most areas of energy, in transport more widely (buses, rail, airports etc), and in the property sector including the private rented sector. A major concern would be if the private equity model is brought more significantly into the healthcare sector, as some predict.

High user and consumer prices are an essential feature of the dysfunctional ‘offshore’ private equity financial model, as is increasingly outdated and obsolete infrastructure and services starved of investment. The result is what we see, crumbling infrastructure and an under-developed economy, a worsening UK trade deficit, high inflation and higher interest rates, all of which adversely affects trade and constrains international competitiveness, with wider societal downsides. It is therefore little wonder many countries view the UK private equity model as politically and socially unacceptable.

MY COMMENTS

It is impossible to read Alf’s paper without recognising that this is precisely why Scotland gets little or no benefit from these crucial sectors in our national or local economy. It inhibits trade and means we are not using these potential assets to build the wider economy. It’s not rocket science and most people with a background of business and industry can see it clearly. The public rely on our Politicians to look out for our interests. Clearly they have not being doing so, for a very long time if the truth be told. Maybe they don’t understand, or are very tied up doing other things, but I see no evidence anything they could possibly be doing that could have a bigger impact on jobs, prosperity and future trade than ending the sell off of Scotland to people and organisations seeking a quick buck and with a mentality of to hell with the consequences.

I am, as always

Yours for Scotland.

BEAT THE CENSORS

Sadly some websites seek to censor what their readers have access to read. This is particularly true of sites whose existence is primarily to support the views of one particular party and they seek to block articles which do not slavishly support that particular doctrine. My readers have worked out that the best way to defeat that attack on the freedom of speech and thought is to share my articles widely, thus defeating any attempt at censorship. My thanks for this.

SALVO AND LIBERATION

Are playing a crucial role in taking Independence forward. This site limits donations to Yours for Scotland to a maximum of £3. We do not need more as all we seek to do is to cover the costs incurred in running the blog therefore once this is secured each year all further donations are forwarded to Salvo and Liberation. My thanks for all who choose to support us in this way. It is appreciated.

SALVO MERCHANDISE

What's Your Reaction?