UNEMPLOYMENT creates IMPOVERISHMENT Part 2

UNEMPLOYMENT creates IMPOVERISHMENT PART 2 by Neil Tye EMPLOYMENT delivers WELL-BEING ‘FULL EMPLOYMENT creates WELL-BEING, ECONOMIC GROWTH and stabilises low INFLATION’ The Public Purpose Benefits of a Full Employment Policy: Today, ‘work’ or beneficial activity is the pillar for human well-being and extremely important both mentally and physically. It is a real necessity and a by-productContinue reading "UNEMPLOYMENT creates IMPOVERISHMENT Part 2"

UNEMPLOYMENT creates IMPOVERISHMENT

PART 2 by Neil Tye

EMPLOYMENT delivers WELL-BEING

‘FULL EMPLOYMENT creates WELL-BEING, ECONOMIC GROWTH and stabilises low INFLATION’

The Public Purpose Benefits of a Full Employment Policy:

Today, ‘work’ or beneficial activity is the pillar for human well-being and extremely important both mentally and physically. It is a real necessity and a by-product of our ancient past that provided an organised and natural altruistic (unselfish) purpose that many living creatures share for their own levels of survival. Work gives pleasure and manages people’s individual endeavours, social necessities, or personal ambitions.

Remunerated ‘Work’ (employment), at a human personal level, is the experience of activating one’s consciousness in providing the financial fuel for one’s social survival. By utilising either a physical and mental means it will deliver the financial return requested in compensation for the service or product provided.

With a Full Employment policy, the government becomes the ‘employer of last resort.’ However, with a mix of Private and Public sector workers in place the minimum national public wage level will be set by the government at a fixed level. Thus, all other Private wages will not fall below the government’s minimum wage, Therefore, if the wages are stable then that in turn will help stabilise consumption demand, output prices and inflation.

The minimum wage should not be determined by the private sector’s capacity to pay. It should be an expression of the aspiration of the society in terms of the lowest acceptable standard of living.

Work and employment are very much inseparable and as part of everyone’s daily life and they are crucial to a person’s dignity, family cohesion, community spirit, well-being and beneficial development for both individuals and the nation.

Without employment the collective qualities of well-being disappear and then normality becomes abnormality, confidence becomes scepticism and well-being becomes sufferance.

The ultimate life-threatening spiral of long-term unemployment is the loss of mental well-being.

The Accountability of Government:

When the largest institution in the UK fails to address the basic needs of people then social problems occur. That institution is government, and the most important need is employment and the reciprocal effective and removal of unemployment.

A government that condones a deliberate ‘Unemployment’ policy choice that provides only less than minimal welfare and services delivers a sick nation by maintaining poverty. This violates any reasonable definition of social and macroeconomic efficiency.

Employment at the national level should be a provision of the nation’s government as a matter of economic responsibility. Relying on private businesses to provide employment for everyone is an absurdity. Ask any corporate ‘Director’ because they simply do not have the financial capacity.

Private businesses only hire the quantity of labour needed to produce the level of output that is expected to be sold at a profitable price.

The true value of employment should bring together the access of productive and suitably remunerated income providing the social protection for families, personal development, and social integration. The ultimate objective of work is that it should be safe, creative, and enjoyable, whether you work alone or within a team.

Wealth Inequality – The Real Effects:

Wealth Inequality in the rUK and Scotland is a genuine problem and is currently at a ‘Medium’ level of 36.6% which is the highest in Europe. The population of the UK have been suffering from low-income levels for many decades, due to excess under-employment and unemployment. While the rich get richer the poor are getting poorer. This inequality is exacerbated by economic policies that provide financial advantages to a particular group rather than the whole group. The effects are wealth at one end of the scale and poverty at the other end. History has shown us many times that this often results in greater recessionary episodes and social destitution.

Wealth Inequality is measured using a method known as the ‘GINI Coefficient’ devised by Italian statistician and sociologist Professor Corrado Gini in 1912.

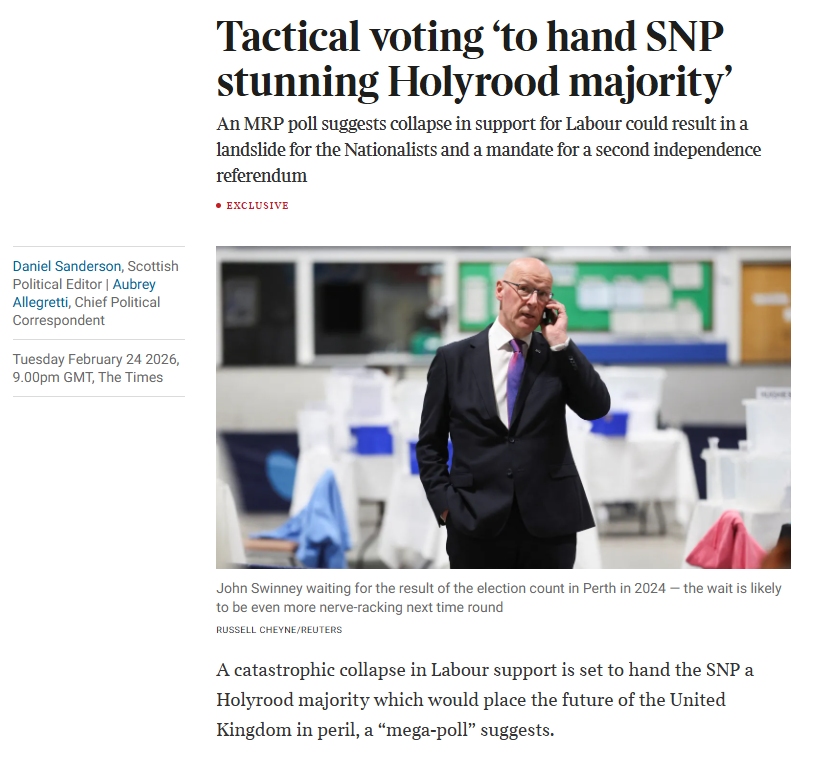

The graph shown above is not a singular ‘Gini Graph’ but a composite graph of ‘Gini’ values indicating the UK’s ‘Wealth Inequality’ and measured annually from 1978 to 2022.

Note that, in 1979 Mrs Thatcher became PM and what followed, for the next 12 years was dramatically devastating for the next 31 years, thereafter. First a major theoretical revolution occurred whereby ‘Keynesianism’ economics was supplanted by ‘Monetarism’ in the late 1970’s.

Secondly the demise of persistently high levels of employment became conversely persistently high levels of unemployment. This is reflected in the 10% steep climb in Wealth Inequality and rising continually and is also shown as a steep rise between, 1974-1985 in the ‘Unemployment’ graph shown in Part 1.

The graph continues to rise and fall at a ‘medium level’ irregularly through to today, which indicates economic instability and greater inequality.

The singular cause of the UK Wealth Inequality is the policy endorsed by government which is to uses its Central Bank’s ‘Monetary Policy’ to alleviate an increase in the inflationary spiral by increasing the Bank Base Rate for borrowing.

The impact of the higher interest rates leads to a squeeze on real wages with a consequential negative impact on necessary spending for products, food, and fuel. Companies will be less willing to invest in new projects as their costs increase.

Consequently, if borrowing becomes more expensive there will be at some point a time when workers will have to be laid off becoming unemployed. The inflationary process will eventually reduce, but that could be some time well into the future.

Economically, the UK has still not recovered from this 1978 open policy of Free Markets, Deregulation of the UK Labour laws and the macroeconomics of Neo-liberalism and business Capitalism

The effect of raising interest rates drains wealth from those who must borrow in the Private sector, creating further unemployment and social deprivation, businesses collapse, and the nation will be during another recessionary economy. Raising Interest rates causes greater Wealth Inequality.

What is Inflation:

There are misconceptions as to what price inflation actually is. An increase in prices is a necessary but not sufficient condition for an inflationary process to unfold. Thus, a negotiated pay increase for workers, or firms increasing their process to try to increase profit, or a rise in local prices of imported goods following a depreciation of the currency exchange rate, may or may not initiate an inflationary process. A one-off price rise is not an inflationary episode

Inflation is the rise in the price level of products, housing, fuel, or food all known collectively as the ‘the cost of living.’ But to be an inflationary episode means that it must be a continuous event over a period of months, not just once. Inflation (and deflation) is happening all the time as economic growth is gradually increasing or decreasing.

Inflation and economic growth are linked as an effect relating to the increase in the development of civilisation and world population. The mass transportation of products throughout the globe is a cause of inflated prices that we are prepared to pay to maintain our survival.

Inflation is also the result of a conflict that is characteristic of capitalist economies, between workers seeking to maintain or achieve a higher wage, while businesses seek to maintain or raise their profit rate. In this context there are two differential types of causes of an inflationary process:

There are two types of causes that are jointly known as the ‘Conflict Theory’ of inflation.

- Cost-Push: Where the price of goods increases due to wage increases or a raw material cost that increases the price of a product.

- Demand-Pull: Refers to the situation where prices start accelerating continuously because the level of demand growth outstrips the capacity of the company to respond by expanding output.

Controlling these two types of ‘conflict’ inflationary scenarios, at company level, can only be eliminated by an increase in financial investment or monetary ‘oxygen’ because the process needs higher levels of economic activity. In this way the business growth will be sustained while the inflationary spiral will be extinguished.

In 1979 the fateful policies of Mrs Thatcher’s government, which followed her imperial reign for the next 12 years, reflected the reverse policy as described above. It culminated in the demise of UK industries that needed government financial investment to reinvigorate it with modern technologies and modernisation. That did not happen, and government took a back seat and left thousands of workers and families into a state of recessionary economics and Wealth Inequality.

Controlling Inflation Episodes – The myth of Interest Rates reducing Inflation:

The UK Bank of England, and the future Scottish Central Bank, has and will have at its disposal all the financial fiscal and monetary powers to undertake any financial resolution necessary to control the economy. This includes recessionary inflation episodes.

In the UK, the current method to controlling inflationary episodes in the UK economy is to raise the Bank of England’s (BofE) interest rate known as the ‘BofE Base Rate.’ This is the interest rate that Commercial Banks receive to maintain their Bank Reserves at the BofE. The Commercial Banks will use this rate factor when considering financial loans to households or businesses.

This form of interest rate targeting has remained the primary arm of macroeconomic policy since the early 1970’s and is still designed to ‘Control Inflation’. However, it is rarely explained how discretionary changes in ‘Monetary Policy’ through changes in the target ‘BofE Base Rate’ can effectively target the inflation rate.

At best, interest rate changes lead to changes in spending because borrowing credit from Banks becomes more expensive thus the residual objective can only be to try to curtail spending into the economy to limit the supply of products. But this does not happen.

The reality is that the raising of interest rates will not reduce the desires of households or businesses to spend less because of the necessity for the basic requirements, food, fuel, energy, equipment, and sales. These will always be required as a matter of survival. The consequence is that more private levels of indebtedness will prevail, and business will be unable to provide workers with higher inflation rated wages due to the excessive borrowing they endure.

The critical argument here is very apparent and that is that the mechanism of raising interest rates to reduce Inflation effect does not in most cases, effectively eliminate the ‘CAUSE.’ It effectively creates an even greater problem that being a spiral of unemployment and business bankruptcy. This leads to a recessionary economy and greater impoverishment.

The Solution to Control Inflation and maintain a buoyant Economy:

The primary objective of government should be to maintain and rejuvenate productive activity, not reducing or disengaging from it. If there is no productivity, then recession will be a road to economic ruin. When economic activity is strong, the commercial banks are more willing to extend credit and businesses are more willing to pass on nominal wage demands because it becomes harder to find trained labour.

The logical economic alternative to solving an inflation episode is not to apply a monetary policy that causes an increasingly expanding inflationary episode and an economic recession! END

Note that, a recent (6th Oct. 2022) critical report of the BofE issued by one of its own members, (Jonathan Haskel), warned the Monetary Policy Committee (MPC) that ‘unemployment is being a potential block for UK economic growth’ because of the cost of borrowing. Also, ‘while other neighbouring European countries have seen economic growth, the UK has experienced a severe rise in economic inactivity, otherwise described as Unemployment.’

Government’s monetary policy settings, by the BofE, must accommodate the inflationary struggle by leaving its BofE Base Rate’ (interest rates) unchanged and maintained it at a low value of 0.1%.

Commercial Banks would continue to extend loans to businesses which will create deposits in the accounts of its business clients. The Central Bank would then ensure that there were sufficient financial reserves in the banking system to maintain stability in the payments system.

If the workers demand a normal wage increase, because of the process of economic growth, business owners could meet these thus fuelling the demand for more business loans with little constraint.

Full Employment the Conclusion:

At a national level, a ‘Full Employment Policy’ is fundamental to the stimulation of the Scottish economy as employment yields useful production, returning thousands of unemployed people back into work, developing working skills, social cohesion, social wellbeing, and economic stability.

Employment and will improve the look, feel, and life quality of deprived areas, making them vibrant and desirable places to live and run businesses. Employment makes people feel good and smile again. Additionally, on-the-job training and re-education will be a fundamental part of the measures to rehabilitate the unskilled back into the skilled private labour market.

An Independent Scottish Nation that has a government that operates its own currency, Scot£, that is free floating, with a Central Bank that issues the currency will have the fiscal and monetary powers to undertake the policy of ‘Full Employment.’

However, if we keep using the Westminster £Sterling then all of this will be impossible and irrelevant.

I hope this message goes out to all the good people in Scotland who will share our cause to others and that these policies and education will become part of the new beginning.

END

Neil Tye – 08.11.22

MY COMMENTS

My thanks to Neil for these articles which I hope helps readers understand more about the various strategies Government can employ. The current UK Government are certainly not intent in pursuing full employment. I fear this will result in a host of business closures and a consequential rise in unemployment this winter. They think this will help control inflation. It won’t.

I am, as always

YOURS FOR SCOTLAND

BEAT THE CENSORS

Unfortunately some pro Indy websites are not pro Indy. They are pro SNP sites and ban any content on their sites which dares to question the SNP or the SNP leader. They seek to censor discussion and free expression. Fortunately many of my readers share the articles on Yours for Scotland frequently and because of this the attempted censorship is proving ineffective. This support is very important and I thank everyone who share and protect freedom of speech and choice.

FREE SUBSCRIPTIONS

Are available on the Home and Blog pages of this site. This will ensure you will receive notification of all new posts by email and be the first to get key information when it is released.

SALVO

The progress of Salvo has been the most encouraging development of 2022. It is doing sterling work educating Scots about the Claim of Right and spelling out what it means that the Scottish people are sovereign, not any Parliament. All donations to this site for the remainder of 2022 will be forwarded to Salvo to support them in developing and expanding this valuable work.

LIBERATION.SCOT

Please register at Liberation.scot and join the mass membership organisation that will be the signatories to our application to the UN, debate and organise a new Scottish Constitution. The membership of Liberation is also where the first members of Scotland’s National Congress will be balloted for selection.

What's Your Reaction?