WELL CAN WE?

A GUEST ARTICLE FROM TIM RIDEOUT OF THE SCOTTISH CURRENCY GROUP. Can Scotland Afford to pay the State Pension? In summary: Scottish state pensions will be more than covered by Scottish National Insurance. Annual NI receipts = £11476m Annual Pensions = £8517m Leaves £2959m surplus for other benefits. Source Table 1.1 & Box 3.2 GERS 2021 FullContinue reading "WELL CAN WE?"

A GUEST ARTICLE FROM TIM RIDEOUT OF THE SCOTTISH CURRENCY GROUP.

Can Scotland Afford to pay the State Pension?

In summary:

Scottish state pensions will be more than covered by Scottish National Insurance.

Annual NI receipts = £11476m

Annual Pensions = £8517m

Leaves £2959m surplus for other benefits.

Source Table 1.1 & Box 3.2 GERS 2021

Full explanation:

Blackford and the First Minister skipping carefree into the pension minefield comes about from failing to answer the four key Indy questions over the last 8 years. Currency, Pensions, Europe and Borders.

The law of the Continuing State (Vienna Conventions 1978 etc) is clear that rUK gets the assets (embassies, gold, Falklands, etc) and the liabilities (UN fees, IMF fees, pensions, National Debt, etc), while Scotland gets what is physically located in Scotland or its territorial waters. rUK would be entitled to remove items from Scotland such as military vehicles and aircraft, paintings in military bases, etc where they can be shown to belong to rUK). For the avoidance of doubt the territorial waters are defined by the UN Law on the Sea, and not by any line drawn by Tony Blair.

Pensions, of course, are a liability. However, there are two distinct types – UK Gov employment pensions (UK civil service, army, diplomatic corps, etc) and the UK state pension. The first the UK absolutely has to pay in full. So that would be anyone resident in Scotland who served in the military or worked for a rUK central department such as HMRC, Foreign Office, Dept of Work & Pensions, and the like. Those will be paid in sterling and those people will have an exchange rate risk. There isn’t an easy way to avoid that.

The second is different – it is a pay as you go welfare entitlement and there is no ‘fund’ behind it (whatever the name, the National Insurance Fund never has more than £20 billion in it because the Treasury clears it out). As ScotGov will be taking over all the tax revenues and NI, then it is obvious and reasonable that ScotGov take over the payment of the entitlements, i.e. the state pension. This should be a very easy deal. Also, since we are relieving the UK of a very large liability there has to be a quid pro quo, such as no discussion of taking any share of the so called ‘National Debt’. Can ScotGov ‘fund’ the pension? Of course as we would get the tax (not that tax funds anything specific). In fact because our life expectancy, especially for men, is less than in England then it is likely we could increase the Scottish Universal Pension at no extra cost. Some calculations I have done suggest workers in Scotland currently subsidise pensioners in England on average precisely because we die younger but all pay the same NI. 72 for a man in Easterhouse vs 90 for a man in Chelsea. We should also look at increasing the SUP to the EU average, but that requires we have our own currency. Getting that currency is, of course, why the Scottish Currency Group exists.

Can Scotland afford the State Pension? The answer is Yes and we can use the Brit Nat bible of the GERS date to show that. Table 1.1 in GERS 2021 puts National Insurance collected in Scotland at £11,476 million, which is 8% of the UK total. NI is more regressive than Income Tax as Scottish income tax is only 6.6% of UK total. The State Pension (in Box 3.2) is given as £8,517 million. So it covers the State Pension in Scotland with £2,959 left to go towards other welfare payments. Universal Credit is put at £3,170 so our NI receipts essentially cover both the State Pension and Universal Credit. Housing Benefit (£1380m) does not come out of the NI Fund. HMRC Child and Tax Credits (£1864m) also not from the NI Fund. Scottish Social Security (£3897 m) is separately paid out of the block grant. So just leaves ‘Other DWP Social Security’, whatever that is, of £2593 m. That may or may not have anything to do with the NI Fund, most likely not, if it is e.g. pensioner TV licences, winter fuel and cold weather payments, and things like that.

The position in regards to the present UK State Pension is really no different to other National Insurance entitlements such as Unemployment Benefit (I know it doesn’t really exist, but Scotland certainly needs to get back to a proper scheme – it was never means tested and it was no questions asked for 6 months so long as you had two years NI payments). Scotland will take over all those in work entitlements and in just the same way it will take over the rUK State Pension. That will be for folk domiciled in Scotland on Indy Day, perhaps with some residency qualification such as 1 year prior to Indy, either in receipt of the rUK state pension at that point or via transfer of their NI record for those not yet getting a pension. As we plan to increase the SUP to the EU average you don’t want to encourage of rush of pensioners from England moving north just before Indy Day in order to qualify for a higher Scottish Pension.

After Independence there are existing mechanisms for transferring state pension entitlements between some countries which we could negotiate with rUK (for example Scots moving to England could transfer into the rUK state pension and the same in the other direction with a net payment one way or the other depending on how many and how many years of entitlement). Otherwise standard rules would be Scotland pays out entitlements to the SUP regardless of where you now choose to live, and rUK pays out their entitlements even if the pensioner chooses to move to Scotland.

Hope that helps,

Tim

Dr Tim Rideout

Director

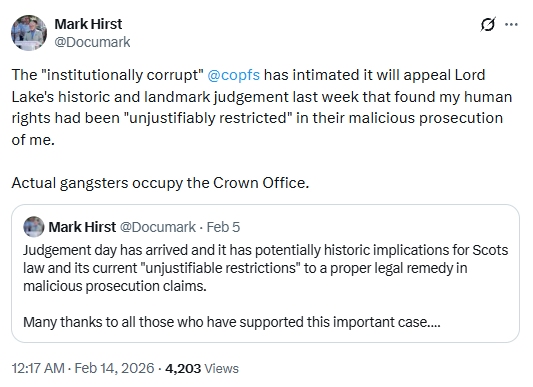

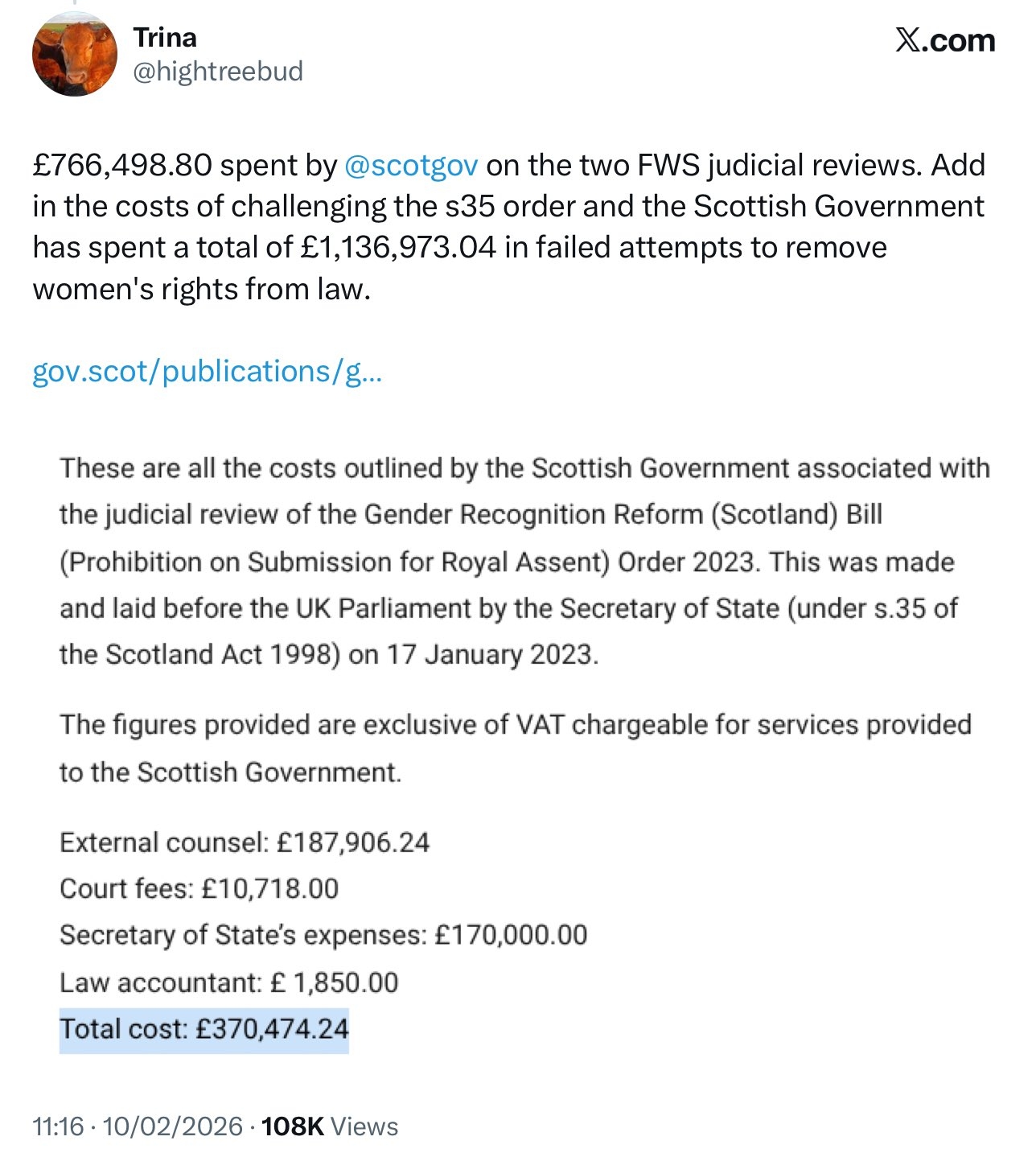

BEAT THE CENSORS

Sadly some sites had given up on being pro Indy sites and have decided to become merely pro SNP sites where any criticism of the Party Leader or opposition to the latest policy extremes, results in censorship being applied. This, in the rather over optimistic belief that this will suppress public discussion on such topics. My regular readers have expertly worked out that by regularly sharing articles on this site defeats that censorship and makes it all rather pointless. I really do appreciate such support and free speech in Scotland is remaining unaffected by their juvenile censorship. Indeed it is has become a symptom of weakness and guilt. Quite encouraging really.

FREE SUBSCRIPTIONS

Are available easily by clicking on the links in the Home and Blog sections of this website. by doing so you will be joining thousands of other readers who enjoy being notified by email when new articles are published. You will be most welcome.

What's Your Reaction?